The automotive industry is at a pivotal moment, driven by the relentless pursuit of electrification, efficiency, and autonomous capabilities. At the forefront of this revolution are innovative technologies that challenge traditional vehicle architectures. Among these, the in-wheel motor stands out as a potentially transformative solution. By integrating the electric motor directly into the wheel hub, this technology promises to redefine vehicle design, performance, and functionality, paving the way for a new generation of mobility.

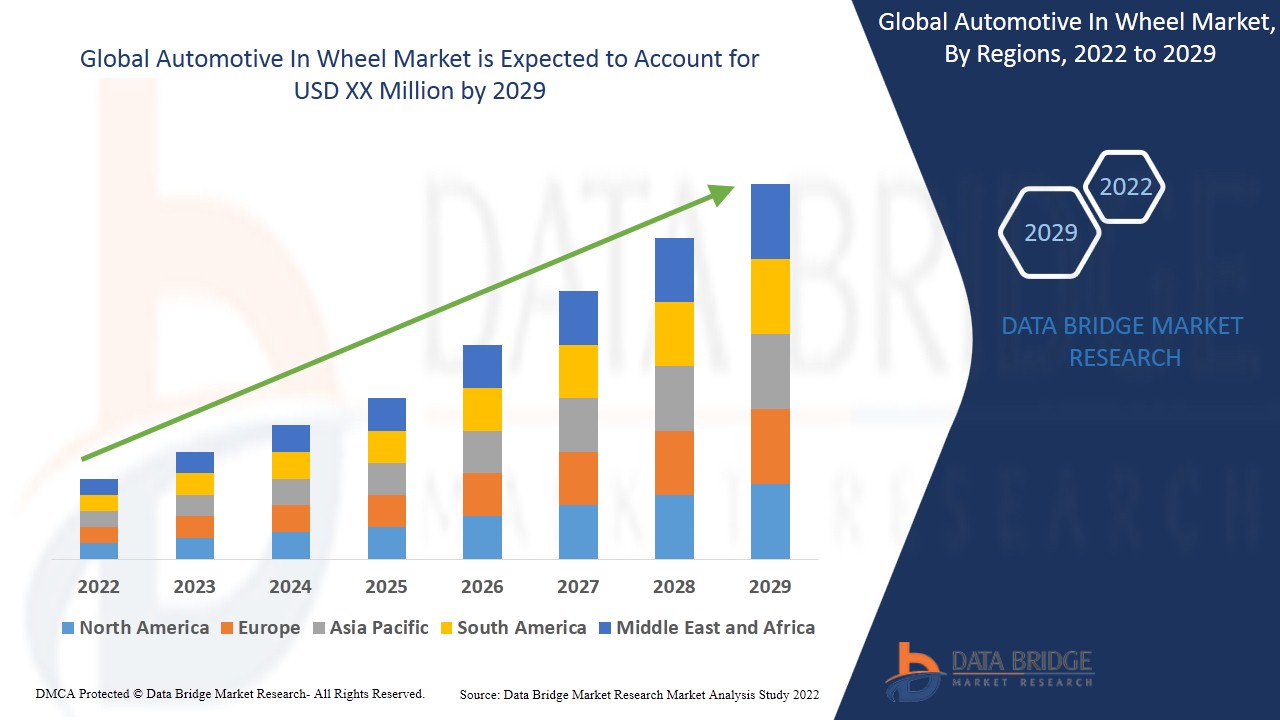

The automotive in wheel market is expected to witness market growth at a rate of 20.60% in the forecast period of 2022 to 2029.

Access Full 350 Pages PDF Report @

Introduction to Automotive In-Wheel Motors

An automotive in-wheel motor, also known as a hub motor, is an electric motor housed directly within the wheel of a vehicle. Unlike conventional electric vehicles (EVs) that use a central motor to drive the wheels via a transmission and drivetrain, in-wheel motors provide direct propulsion to each wheel independently. This innovative design eliminates the need for traditional components like axles, differentials, and bulky transmissions, significantly simplifying the vehicle's mechanical structure.

The concept of in-wheel motors is not new, with Ferdinand Porsche developing early versions over a century ago. However, recent advancements in motor technology, power electronics, and battery energy density have made in-wheel motors a far more viable and attractive option for modern EVs and autonomous vehicles. They offer distinct advantages such as improved space utilization, enhanced vehicle dynamics through precise torque vectoring, and greater design flexibility.

Market Size and Growth

The automotive in-wheel motor market is still in its nascent stages but is projected for explosive growth, reflecting the industry's rapid shift towards electric and autonomous vehicles. In 2024, the market size was estimated to be around USD 1.28 billion. However, this is just the beginning of a significant expansion. Projections indicate a remarkable Compound Annual Growth Rate (CAGR) of over 30%, with some estimates reaching as high as 37.54%, from 2025 to 2033 or 2034. This would propel the market to reach values ranging from USD 22.57 billion to USD 28.33 billion by 2033 or 2034. Such aggressive growth underscores the profound impact this technology is expected to have on the future of automotive propulsion.

Market Share Dynamics

Currently, the Asia-Pacific region holds the largest market share in the global automotive in-wheel motor market. This dominance is primarily driven by the region's strong focus on electric vehicle manufacturing and adoption, particularly in countries like China, Japan, and South Korea. These nations are investing heavily in EV infrastructure and promoting the widespread use of electric mobility solutions.

In terms of vehicle type, passenger cars are anticipated to hold the largest share of the in-wheel motor market, reflecting the higher volume of EV sales in this segment. However, commercial vehicles are also expected to see significant growth as fleet operators increasingly adopt electric solutions for last-mile delivery and urban logistics. From a propulsion type perspective, Battery Electric Vehicles (BEVs) are expected to account for the largest share, given that in-wheel motors are inherently designed for electric powertrains. Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) also present opportunities for the integration of in-wheel motors, especially for enhancing electric-only range or all-wheel-drive capabilities.

Market Opportunities and Challenges

The automotive in-wheel motor market presents a compelling set of opportunities and challenges.

Opportunities:

Electric Vehicle (EV) Proliferation: The exponential growth of the EV market is the primary driver for in-wheel motor adoption. As EV technology matures and costs decrease, the demand for compact, efficient, and performance-enhancing propulsion systems like in-wheel motors will surge.

Enhanced Vehicle Dynamics and Control: In-wheel motors enable precise torque vectoring, allowing independent control over each wheel's speed and torque. This significantly improves vehicle handling, traction control, stability, and even opens doors for advanced features like tank turns.

Space Optimization and Design Flexibility: By integrating motors directly into the wheels, the conventional engine bay and transmission tunnel can be eliminated. This frees up valuable space for larger battery packs, expanded passenger cabins, or increased cargo capacity, offering unprecedented design freedom for automotive manufacturers.

Simplified Vehicle Architecture: The elimination of complex mechanical drivetrains (gearboxes, differentials, driveshafts) reduces the number of moving parts, potentially leading to lower manufacturing costs, simplified assembly, and reduced maintenance requirements.

Autonomous Driving Evolution: In-wheel motors provide granular control over individual wheels, which is highly beneficial for autonomous vehicles. This precise control can enhance obstacle avoidance, parking maneuvers, and overall vehicle stability in self-driving scenarios.

Improved Efficiency and Regenerative Braking: Direct power delivery to the wheels minimizes energy losses associated with traditional drivetrains. Additionally, in-wheel motors can significantly enhance regenerative braking efficiency, converting more kinetic energy back into electrical energy to extend range.

Challenges:

Increased Unsprung Mass: Placing motors inside the wheels adds significant unsprung weight. This can negatively impact ride comfort, suspension performance, and overall vehicle handling by increasing inertia at the wheel, making it harder for the suspension to react quickly to road imperfections.

Durability and Environmental Exposure: In-wheel motors are exposed to harsh environmental conditions, including road debris, water, extreme temperatures, and vibrations from potholes. Ensuring long-term durability and reliability under these challenging conditions is a major engineering hurdle and increases sealing and protection requirements.

Thermal Management: Motors generate heat, and their placement within the wheel, often in close proximity to brake components, presents significant thermal management challenges. Overheating can degrade performance and shorten motor lifespan.

Cost and Manufacturing Complexity: While simplifying the overall vehicle architecture, manufacturing four (or more) high-precision in-wheel motors can be more expensive than producing one central motor and a traditional drivetrain, especially at current production volumes.

Integration and Safety: Integrating complex electrical and control systems into each wheel, along with managing power distribution and safety protocols for multiple independent motors, adds significant engineering complexity and requires robust fail-safe mechanisms.

Limited High-Speed Performance: While excellent at low speeds and for torque delivery, some in-wheel motor designs, particularly those without integrated gearing, may face efficiency challenges at higher speeds.

Market Demand

The demand for automotive in-wheel motors is inextricably linked to the burgeoning electric vehicle market and the ongoing pursuit of innovative vehicle designs. As consumers increasingly prioritize fuel efficiency, lower emissions, and advanced features, the underlying technologies that enable these benefits gain traction. The demand is further fueled by the desire for enhanced driving dynamics, improved cabin space, and the foundational requirements of future autonomous vehicles. As the global EV fleet expands and automotive OEMs continue to push the boundaries of design and performance, the demand for in-wheel motor solutions is expected to intensify across both passenger and commercial vehicle segments.

Market Trends

Several pivotal trends are shaping the automotive in-wheel motor market:

Miniaturization and Power Density: A continuous trend towards smaller, lighter, and more powerful in-wheel motors is crucial to mitigate the unsprung mass challenge and improve overall vehicle performance.

Integration of Advanced Technologies: Further integration of power electronics, sensors, and control units directly within the wheel assembly to create more compact, efficient, and intelligent motor units is a key development.

Focus on Thermal Management Solutions: Innovations in cooling technologies, such as advanced liquid cooling systems, are critical to address the heat dissipation challenges associated with in-wheel motor operation, especially under high loads.

Collaboration Between OEMs and Suppliers: Automotive manufacturers are increasingly partnering with in-wheel motor technology specialists to accelerate research, development, and integration of these systems into their upcoming EV platforms.

Axial Flux Motor Dominance: Axial flux motors, known for their compact size, high power density, and efficiency, are gaining prominence in the in-wheel motor segment compared to traditional radial flux designs.

Modular and Scalable Designs: The development of modular in-wheel motor platforms that can be easily adapted for various vehicle types and power requirements (e.g., FWD, RWD, AWD configurations) is a significant trend, offering flexibility to manufacturers.

Autonomous Vehicle Synergies: The inherent advantages of independent wheel control make in-wheel motors a natural fit for future autonomous vehicles, where precise maneuverability and distributed control are paramount. This synergy will further drive research and adoption.

The automotive in-wheel motor market, though facing complex engineering challenges, is poised for revolutionary growth. Its ability to fundamentally reshape vehicle design, enhance performance, and align with the future of electric and autonomous mobility positions it as a technology to watch closely in the evolving automotive landscape.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Write a comment ...